Why Mars plans to more than triple the amount of renewable energy it buys

Food and candy maker Mars set a goal in 2021 to match 100 percent of annual electricity use at its offices and factories — roughly 2 terawatt-hours in 2025 — with contracts for clean energy such as solar and wind power.

Now it’s committing to do the same on behalf of suppliers and customers through a new initiative dubbed Renewables Acceleration.

The program, launched in April, will use Mars’ experience in negotiating power purchase agreements to arrange additional contracts that cover the estimated amount of electricity used in the production, distribution and consumption of its goods. Initially, that could be another 6 to 7 terawatt-hours of electricity, three times what Mars is already planning to buy.

The rationale: Many Mars suppliers are too small and inexperienced to procure electricity from solar or wind farms on their own. While many large companies push suppliers to adopt emissions reductions strategies and buy renewables, they aren’t transitioning fast enough at a time when climate experts are calling for a tripling in renewable energy capacity by 2030.

So far, Mars has signed enough clean energy power purchase contracts to cover 58 percent of its own electricity consumption, as of the company’s 2024 environmental update. Extending this idea to the Mars supply chain creates an opportunity to cover electricity related to smaller suppliers it cannot engage directly, said Kevin Rabinovitch, global vice president of sustainability and chief climate officer at Mars. Meanwhile, it will help Mars’ biggest business partners focus resources on investments or process changes to reduce emissions directly.

“The most exciting thing about this is this lets us do something fast at scale that can help contribute to this sort of broader goal of tripping renewables and taking action now,” he said.

How the concept works

Mars came up with the idea for this approach three years ago, as it contemplated new ways to cut Scope 3 emissions, which reflect upstream activities at suppliers (such as growing raw ingredients) and downstream consumption of its products (such as microwaving a rice pouch).

The sustainability team studied product life cycles to calculate the electricity use tied to each phase. The approach doesn’t contemplate other factors that contribute emissions, such as methane production at dairy farms.

For example, here are ways electricity is used for a Mars rice product:

- Fertilizer production

- Farm equipment, such as irrigation systems

- Ingredient processing and packaging

- Distribution warehouses

- Retail stores and logistics activities

- Consumer usage

Mars calculates the amount of electricity related to these functions and activities using greenhouse gas emissions inventory data it already collects for carbon accounting purposes and publicly available government data, and then extrapolating what portion comes from electricity.

The company figures that about 10 percent of its total carbon footprint can be addressed with the Renewables Acceleration approach. That’s where Mars came up with the 7 terrawatt-hours number it’s seeking to address through this approach.

The calculations weren’t easy because you have to “crack open” the data, Rabinovitch said, but many multinational companies have access to these metrics. “I think everyone will agree that doing activity-based footprinting is better than spend-based forecasting because you get more precision, more accuracy, more insight,” he said.

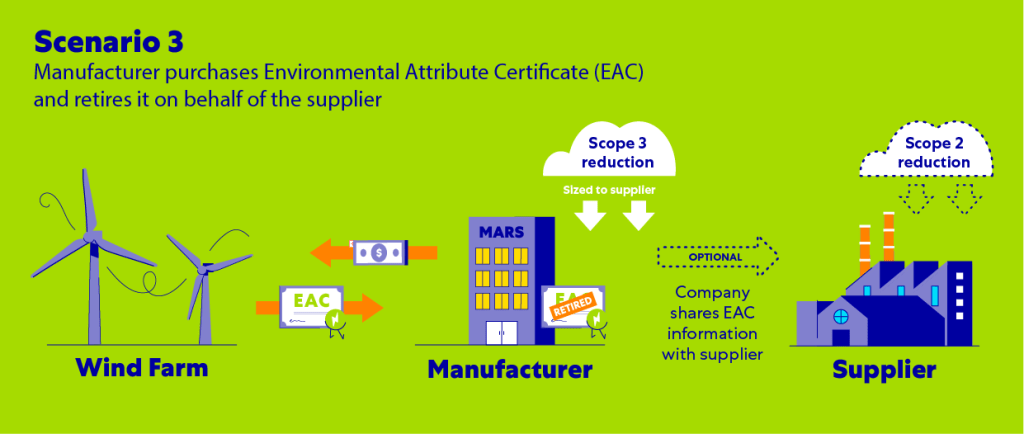

Mars plans to apply the renewable energy certificates (RECs) from the clean electricity it buys to cover these activities to its Scope 3 inventory, rather than Scope 2, where calculations related to energy used for Mars’ direct operations are reflected.

“There’s no functional difference between a manufacturer retiring an [environmental attribute certificate] for a supplier and the manufacturer selling or even simply giving the supplier the REC who then retires it themselves,” Mars said in a white paper explaining Renewables Acceleration. “However there is a huge practical difference in that a manufacturer coordinating REC transfers to thousands of suppliers and customers and millions of customers is incredibly inefficient and adds no climate benefit.”

No precedent

There’s no established methodology for an approach like Renewables Acceleration under existing Greenhouse Gas Protocol reporting guidance, Rabinovitch said, but there’s also no specific restriction prohibiting the approach.

“If you’re looking for the answer from a standard that was written long before you had the idea, it becomes a hurdle to innovation,” he said.

Mars still plans to work directly with suppliers to encourage direct investments in clean electricity and other emissions-reduction activities, such as regenerative agriculture practices or manufacturing equipment upgrades.

While important, initiatives of that nature tend to yield progress slowly, which is one reason to assess approaches such as Renewables Acceleration seriously, said Oliver Hurrey, founder of consulting firm Galvanised. “If you look at the process to get suppliers invested in renewables, it is overly complicated. Are we guilty of over-engineering and not getting on with the things we need to do?” he said.

What’s next

Mars hasn’t negotiated a contract using the Renewables Acceleration method yet, but it’s working on the first deals. In addition, Rabinovitch is advocating the initiative with other large multinational companies that have experience negotiating solar and wind power purchase agreements. He’s seeking feedback and hoping to get other companies interested in embracing the approach.

“It’s probably more the sophisticated buyers, where they already know how to buy renewables,” he said. “They’re comfortable with the rules for that, and they’re comfortable with how to sell [the idea] to their business. The only novelty is you’re now covering a megawatt-hour that’s in Scope 3, as opposed to Scope 2.”

The post Why Mars plans to more than triple the amount of renewable energy it buys appeared first on Trellis.