Carbon market turnaround continues as buyers eye more purchases

Is the carbon market emerging from its years-long slump?

A series of new findings suggests it is. Buyer confidence, which had been severely dented by exposés of flawed projects, appears to be returning as market quality inches upward.

The most recent data comes from a survey of businesses in 30 countries carried out by SE Advisory Services, the consulting arm of energy technology company Schneider Electric. Asked about purchasing plans between now and 2030, more than half of respondents said they expected to increase engagement with carbon markets — 29 percent moderately and 26 percent significantly.

The shift is driven in part by the spread of new emissions reduction regulations, particularly in Asia, that allow companies to use credits to hit targets. “These early movers are building the inventories, relationships and capabilities they will need when voluntary becomes mandatory,” the report authors noted.

Buying better

Buyers, particularly those new to the market, are also using new quality signals. The Schneider report found that 55 percent of respondents looked for the Core Carbon Principles, a quality label developed by the Integrity Council for the Voluntary Carbon Market that rubber-stamped its first methodologies in summer 2024. Although the council’s decisions aren’t a guarantee of quality — several of its first approvals were questioned by independent experts — the label is considered a relevant part of a due diligence process nonetheless.

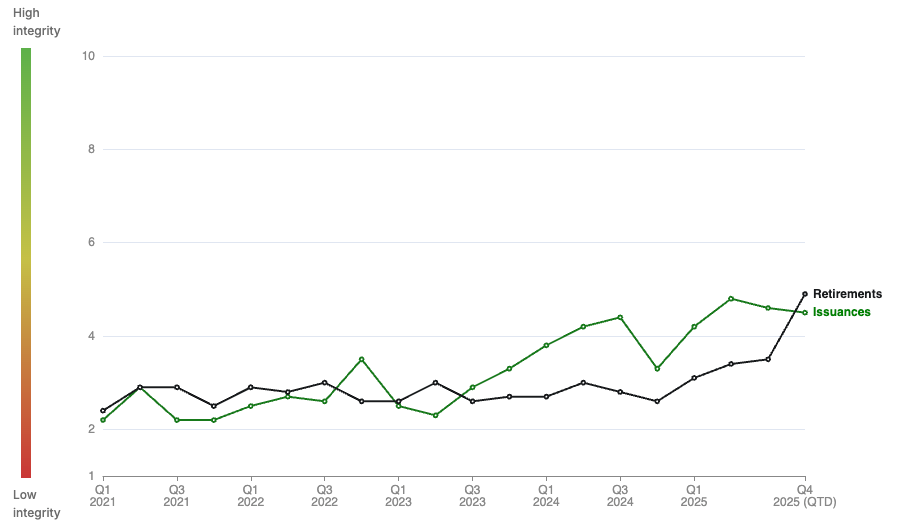

Buyer demand for quality seems to be slowly shaping the market. The integrity of credits issued and retired has been trending steadily upwards since 2021, as measured on a 10-point scale used by Calyx Global, an independent rater of credit projects.

Carbon credit quality trends

A similar uptick was seen by the finance intelligence provider MSCI, which rates carbon projects from AAA to CCC. The company’s second annual report on market integrity, published in September, noted that 35 percent of credits retired in the first half of this year were rated BBB or above, compared with 25 percent in 2022.

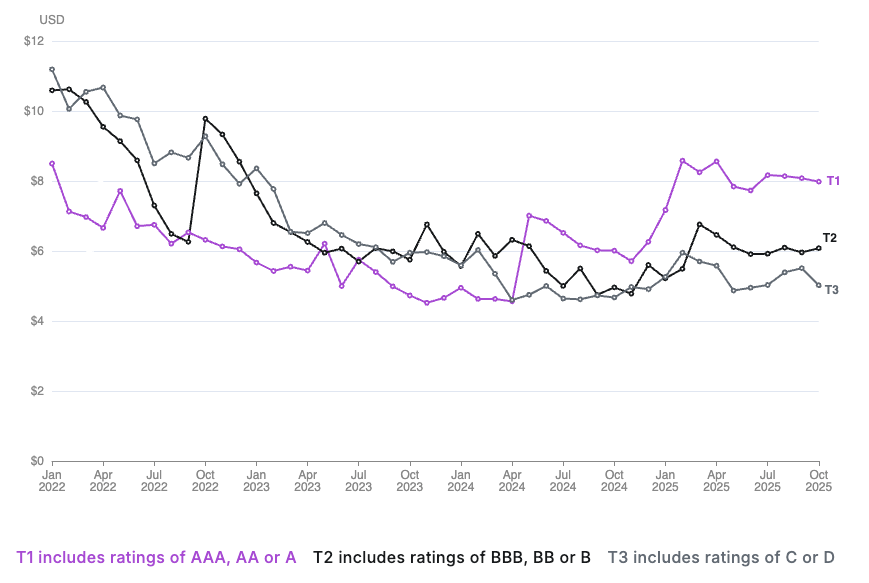

Higher-quality credits are also commanding higher prices, according to an index maintained by Calyx and ClearBlue Markets that offers tools to help companies navigate carbon markets.

Prices for carbon credits in different quality tiers

MSCI data aligns with this: Credits in the company’s high-integrity index traded at more than four times the price of those in its low-integrity index, compared with a two-fold difference in 2024.

‘Intractable’ problems

Still, the most talked-about publication in recent months probably isn’t any of the above. It’s a review of the academic literature on carbon credits, by Joseph Romm at the University of Pennsylvania, which concluded that many popular offset types have “intractable” quality problems.

Many in the industry said Romm’s paper flagged known problems that are being addressed by the integrity council and other organizations. Others — including the Guardian, one of the fiercest critics of carbon markets — cited it as yet-more evidence that carbon credits cannot be trusted. The carbon market may be evolving, but its ability to divide opinions remains unchanged.

The post Carbon market turnaround continues as buyers eye more purchases appeared first on Trellis.