Everlane launched 14 years ago as an ethical apparel brand extolling “radical transparency,” a term that it trademarked. This year, the company has shifted to a “clean luxury” message to elevate its image and focus on sustainability.

Advancing lower-impact, certified and mostly natural materials supports the company’s net zero goal for 2050 and hedges against future regulatory risks. The strategy also seeks to rebuild trust lost five years ago, after workers blasted Everlane for greenwashing and poor labor and social practices.

Steering Everlane forward is Alfred Chang, a former Fear of God and PacSun chief executive. Last October, he became Everlane’s third CEO since co-founder Michael Preysman stepped away in 2021.

Katina Boutis, the senior director of sustainability and sourcing who joined Everlane early in 2021, described the label as “moving from transparency of pricing to transparency of supply chain to a very robust and holistic view of sustainability across social and environmental impacts.”

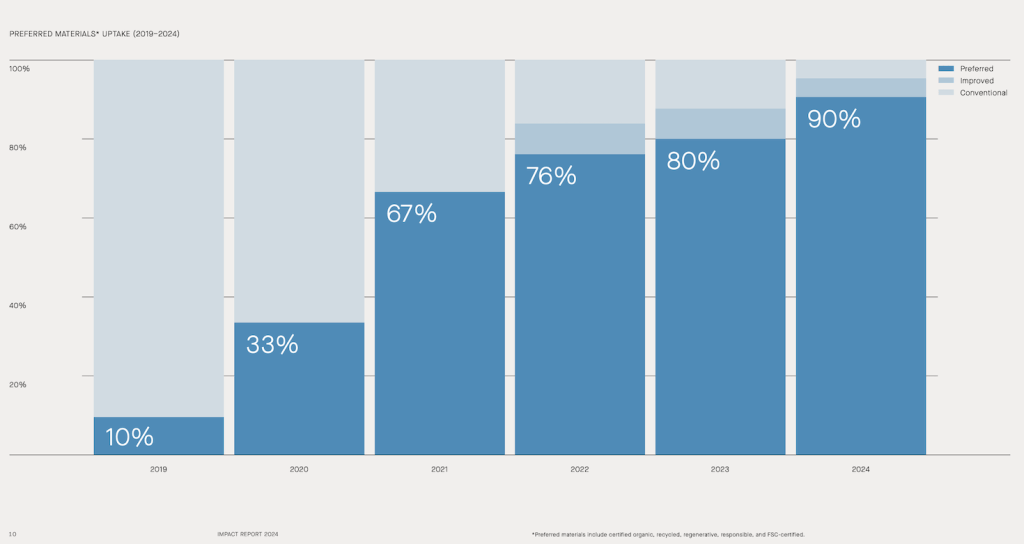

For instance, the company is closing in on a goal of 100 percent “preferred” materials that eliminate virgin plastics by the end of this year, according to Boutis, previously the sustainability director at luggage maker Away. Ninety percent of Everlane’s materials in 2024 met such “lower-impact” standards, such as being organic, recycled or responsibly sourced.

“We’ve proven over the years that we can build a strategy that is meaningful and also attain very lofty goals,” Boutis told Trellis.

Shifting recognition

“Everlane now stands out less for its marketing claims and more for the tangible steps it’s taking on materials, emissions and accountability,” said fashion industry veteran and consultant Liz Alessi.

The company recently topped a list of 52 brands in the 2024 Fashion Accountability Report by Remake, a San Francisco advocacy group.

External estimates, which the privately held Everlane declined to verify, peg its 2024 sales around $200 million or more, with 420 employees across six continents. Although not a brand leader by size, Everlane’s transparent and ethical selling points have invited scrutiny since its founding.

It holds a longtime narrative of eliminating middlemen to sell finely crafted, timeless fashions directly to consumers at a markdown. Its graphic of the “true costs” of a garment went viral.

Tracing the trouble

Despite this focus, Everlane was from its earliest days subject to watchdog complaints that it was short on sustainability details. And those complaints paled next to a March 2020 tweet by Sen. Bernie Sanders, who shamed the company after it had laid off hundreds of retail and customer support roles following attempts to unionize.

That summer, former employees (self-described as the “Everlane Ex-Wives Club”) penned a public letter complaining of the company’s systemic racism and “convenient transparency.”

Following an apology and investigation, Everlane changed leadership and began publishing annual impact reports.

Still, the company’s social responsibility disclosures fall short of being “radical,” according to Luke Smitham, a senior manager at Kumi Consulting in London.

“Currently they are very much within the pack but their communication tends to be more detailed and in some places refreshingly honest,” he said. For instance, the company explains why achieving living wages within its supply chain is very challenging, according to Smitham.

Material matters

Although the company declined to comment on past controversies, it is eager to discuss its progress on sourcing and manufacturing. Both are pivotal to hitting its net zero target, validated by the Science-Based Targets initiative. Sixty percent of the business’s climate footprint originates from materials, and 99 percent from Scope 3 sources.

Boutis described leading sustainability and sourcing across “a very tightly wound, cross-functional team.” She reports to a senior vice president who reports to Chang and the board.

“While many brands dabble in sustainable fabrics, Everlane has created a clear roadmap toward 100 percent preferred materials and tied it directly to science-based climate targets,” consultant Alessi said. “They’ve already achieved 90 percent of their materials meeting those standards and they’re one of the few brands close to fully sourcing sustainably. The choices they make in closing that final gap will define what true material leadership looks like in the industry.”

Everlane’s preferred materials ramp-up

Last year, the company counted an emissions drop of 52 percent per product unit against a baseline year of 2019 — close to the 2030 aim of 55 percent. So far, 95 percent of its cotton is either organic, regenerative, recycled or traceable back to the farm. Everlane invests in climate- and soil-friendly farming projects. In addition, all of Everlane’s virgin leather, manmade cellulosic fibers and down meet third-party standards.

The company has switched 45 core materials to recycled versions, although 4 percent of its polyester and nylon still included virgin sources in 2024. Everlane originally sought to eliminate virgin plastics by 2021 for products and packaging, too. It succeeded with packaging, but moved the product goal to 2025.

“We see this less as pushing out a deadline and more as doubling down on a systems-level challenge,” Boutis said. After realizing that the hard-to-recycle items like zipper pulls, buttons and stretchy fabrics were an industry-wide problem, Everlane sought to support related startups.

In addition, 91 percent of the label’s goods were made under third party-certified chemicals standards, such as Oeko-Tex. And 78 percent of its Tier 2 mills, including for dyeing and finishing, had cleaner chemistry certifications.

“Once we achieve one goal or one milestone, we have to set our sights further,” Boutis said. “Sometimes, what we’ve noticed is that the solutions don’t even exist today.” That applies, for example, to Everlane’s participation with the Apparel Impact Institute in its efforts to help suppliers adopt low-emissions practices.

And although bottle-to-textile recycling may be the best “circular” solution so far, textile-to-textile recycling could be better. To that end, Everlane is partnering with Fiber Club, a multi-brand project by the startup Circ, to feature Circ’s recycled lyocell in a small 2026 collection.

Reducing plastic risks

The natural fiber-forward approach is also about risk reduction. Everlane actively supports policies, including the nation’s first extended producer responsibility law, which in California this year began requiring fashion brands to account for their sold merchandise.

The company developed its first synthetics at the same time it devised materials targets in 2018. That shed light on the lifecycle impacts of polymer fibers, which Everlane limits to items like jackets with low rates of shedding. (Everlane lobbied for a California bill that would have required filters on washing machines.)

“It’s not just the public that is starting to really understand and grapple with the subject,” Boutis said of concerns about plastic pollution from fashion. “The industry and lawmakers in particular are on that same pathway.”

“We’ve been able to demonstrate that we’re making real, meaningful progress, whether it’s our climate commitments or material commitments,” Boutis said. “We are actually succeeding, both on the business end and the sustainability end, which I think many times are positioned as in opposition to one another.”

The post Why Everlane switched to a ‘clean luxury’ message appeared first on Trellis.