In May, 100 days into the second Trump administration, the mood among sustainability professionals was defined by shock, whiplash and acute anxiety. One described feeling helpless in the face of chaos, recalling being an 11-year-old watching their parents fight.

The shock has worn off, replaced by something harder and more grinding: fatigue, pragmatism, and a defiant resolve, according to responses to the latest Trellis sentiment survey, in November.

“It feels like we are in a sustainability recession,” one said. “But I am sure we will eventually come out stronger.”

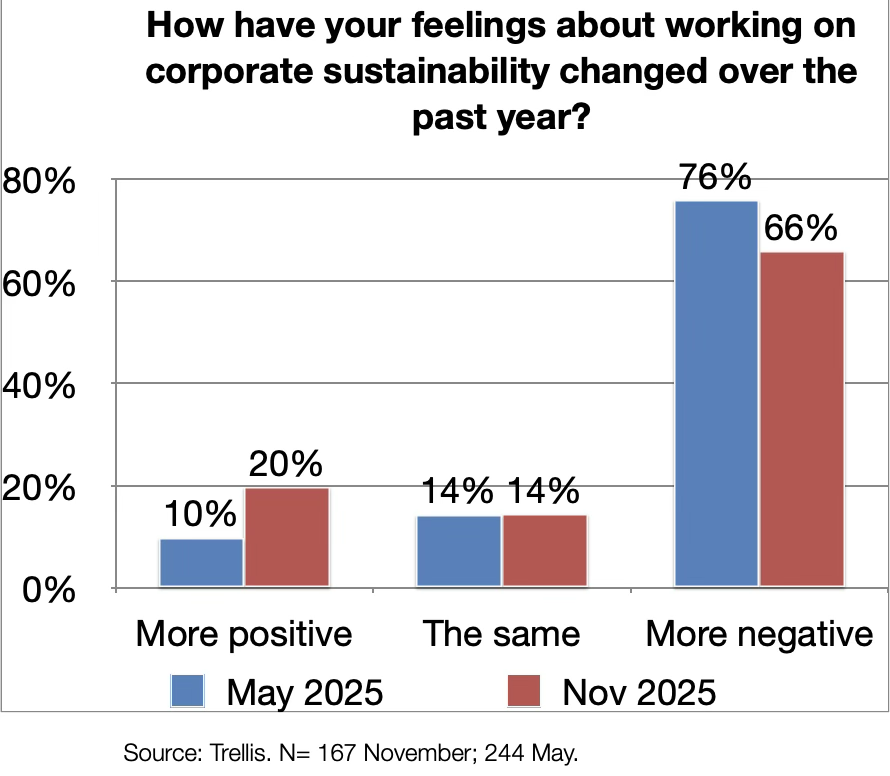

The sliver of Trellis readers who said they had positive feelings about working in sustainability doubled to 20 percent in the recent survey. Two-thirds of the 167 professionals who responded remain negative about the profession, down from three-quarters in May.

A year after Donald Trump was elected, it’s become distressingly clear that U.S. policy has shifted decisively from encouraging decarbonization to promoting fossil fuels.

“I’ve seen cycles before,” one professional said. “This year the dips are lower, and it’s difficult to bear witness as good policies and incentives are being thwarted.”

When leaders step ‘off the gas’

Most galling to many was seeing how “corporate leaders have caved” to the new administration by “taking their foot off the gas” or even “fleeing their responsibility.”

“My company is paying to attend banquets to fund Trump’s ballroom, while laying off 30 percent of the sustainability team and rolling back our commitments,” vented one respondent.

Another described the disturbing “realization that corporate sustainability too often has been an optics play to paper over business as usual.”

Others saw signs of hope, seeing that at least some “companies with integrity have continued their sustainability journeys.”

Bigger challenges; few resources

“Despite the federal pullback and skepticism around climate, the outlook within our organization and among our partners remains highly positive, ambitious and innovative,” one professional said.

In many companies, sustainability departments, which have always been lean, are being cut back.

“The challenges are bigger, but the funds are smaller,” one said.

Many now report “constant pressure from the C-suite to prove why my work in sustainability matters.” Some, at least, say they are rising to the challenge: “It’s pushed me to sharpen my focus and make the case for impact every day.”

Professionals also lamented that their work itself has become more bureaucratic. “I used to be full of hope that I could make a positive impact,” one said. “But the job has been reduced to measurement, tracking and reporting.”

Stay the course

The political minefields and indignities of sustainability work have led some to question the entire profession.

“I’m discouraged that this is not a viable career field given corporate America’s allegiance to the politics of the moment rather than the future of our society,” one said.

Indeed, the opportunities to continue working on business climate issues may be diminishing.

“My sustainability position in renewable energy was just eliminated,” one reader said. “The job market seems very, very tough right now.”

Yet more common, even among the most discouraged professionals, was the urge to “stay the course” because “sustainability isn’t a job; it’s a passion.”

“I was extremely upset and fearful about the prospects of the Trump administration reversing environmental regulations,” one said. “Now I see how sustainability professionals are vital to continuing the quest forward.”

The post Mood check: Sustainability professionals today are discouraged but resolute appeared first on Trellis.