Corporate energy buyers looking to fulfill clean electricity and emissions reduction pledges are rushing to negotiate and close contracts for U.S. solar and wind development projects as the window for qualifying for related tax credits shrinks.

The surge in demand after months of hesitation have pushed U.S. power purchase agreement (PPA) prices up 4 percent since the passage of the One Big Beautiful Bill Act (OBBBA) on July 4. That’s according to a special report published Aug. 13 by LevelTen Energy, which tracks transactions on a quarterly basis. The average cost of a PPA in North America was $57.04 per megawatt-hour in the first quarter, according to LevelTen’s pricing index, available to subscribers.

OBBBA sunsets many renewable energy tax incentives far earlier than the rules set out by the Inflation Reduction Act (IRA). Solar and wind projects must start construction by July 2026 to benefit, and new Treasury rules make the definition for “safe harbor” even tougher: Developers must demonstrate “physical work of a significant nature” to claim credits over a much shorter period of time.

Close to 70 percent of clean energy buyers feel “more urgency to act immediately” to find available projects, lock in potential tax incentives and get ahead of future electricity price increases, LevelTen’s research found.

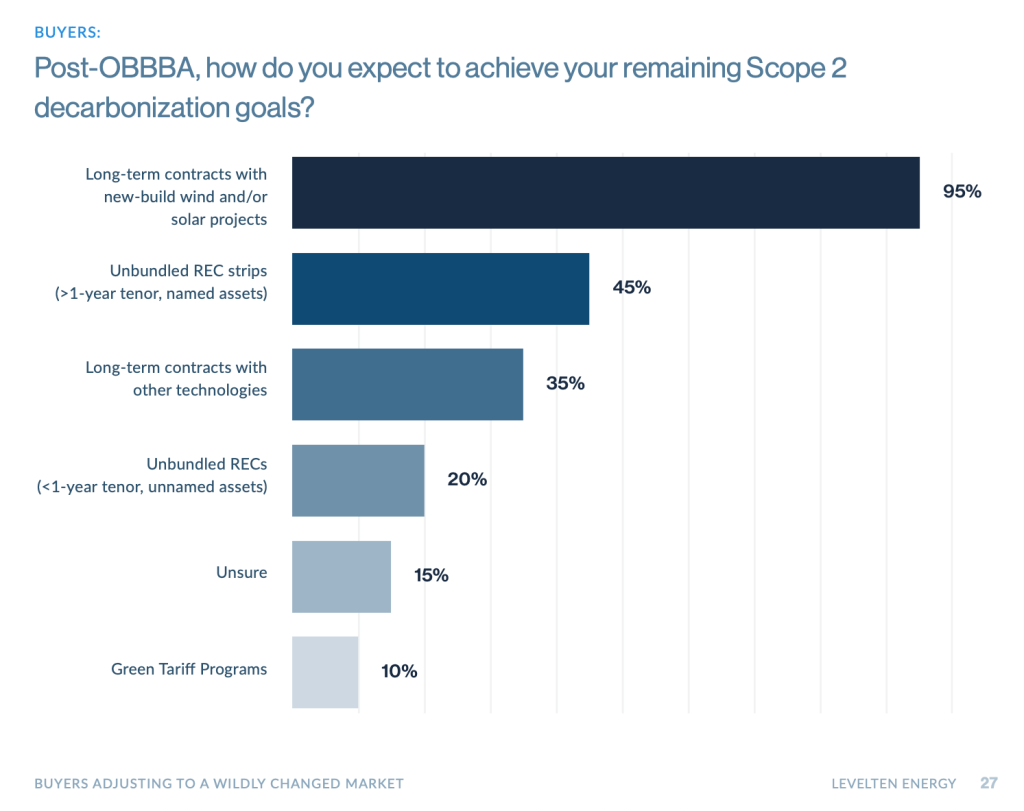

An even bigger number — 95 percent — said PPAs remain a key part of their company’s decarbonization strategy even as prices rise. Buying unbundled renewable energy certificates in order to claim emissions reductions was the second most popular strategy.

Gut check: corporate energy procurement

“All signs and the data indicate that procurement is absolutely still important,” said Rob Collier, senior vice president of marketplaces for LevelTen. “There is a sense with both developers and buyers that now is the moment to secure transactions with projects that are able and eligible to qualify.”

LevelTen typically issues quarterly energy procurement trend reports. The data in its special report was gathered in late July and reflects roughly 250 projects available for corporate offtake agreements. The firm also surveyed and interviewed close to 100 procurement teams evaluating potential deals.

Approximately 16 percent of the buyers plan to pause or reevaluate their procurement plans, while 5 percen indicated there would be no change.

“The buyers best positioned to succeed are those with internal alignment, agile procurement pathways and a focus on signing PPAs with tax-credible-eligible projects,” LevelTen said in its report. “The most competitive projects are moving into exclusivity within weeks, not quarters.”

Wild cards: tariffs and new carbon accounting rules

Complicating matters alongside the OBBBA-related scramble are tariffs on materials such as steel that are making the cost of energy infrastructure more expensive, and proposed changes to commonly used carbon accounting rules that guide how to count emissions reductions related to renewable energy purchases.

A draft proposal under consideration by the Greenhouse Gas Protocol would require companies to match power consumption with low-carbon energy on an hourly basis, in the same grid region where their facilities are located. The revision is expected to be published for public comment this fall. Although it wouldn’t take effect for several years it’s unclear how existing PPAs will be affected.

“All of this collectively is making it harder to add electricity supply at a time when there is a broad acceptance that energy needs are increasing,” said Rick Margolin, director of resource optimization and renewable energy at advisory firm Engie Impact. “If demand is to grow the way we are projecting, we need more supply.”

The tax incentive changes will increase the cost of corporate offtake agreements, but PPAs for solar and wind projects are still a sound option for companies seeking more price certainty over the long term. Energy spending is projected to increase between $8-$14 billion across the industrial sector by 2035, super-charged by the demand for artificial intelligence infrastructure, according to a Rhodium Group forecast.

“What isn’t talked about enough is that even when you take away the credits, the levelized cost of energy is still lower than all of your other forms of energy, including new hydro,” Margolin said.

Challenge: slow internal alignment

Almost 90 percent of developers have shifted construction plans as a result of the OBBBA, with 46 percent planning to “commence construction for as many assets as possible” before July 5, 2026, according to the LevelTen report. Solar projects will benefit the most from this acceleration, as the Trump administration adopts additional obstacles meant to discourage wind farm development.

Sustainability professionals and energy buyers should get individuals on their finance and legal teams involved early as negotiating cycles compress from months to weeks in the pre-deadline rush, experts said.

“For large entities, especially those with little prior PPA experience, getting core stakeholders to sign off on a PPA — while simultaneously educating them on the gravity of the current moment — is an immensely tall order,” LevelTen said.

Interest in emerging clean energy options such as small nuclear and geothermal is growing as the pricing dynamics change and because the OBBBA still favors them with incentives, said Bryen Alperin, managing director at tax incentive specialist Foss & Co. In addition, buyers are more likely to consider installing energy storage alongside solar projects, since they are treated more favorably.

“We may eventually have to assign some value to these technologies,” he said. “Maybe we see more focusing not just on reductions, but on resilience and the stability of the grid.”

The post Higher prices, fewer deals: What’s in store for clean energy buyers appeared first on Trellis.